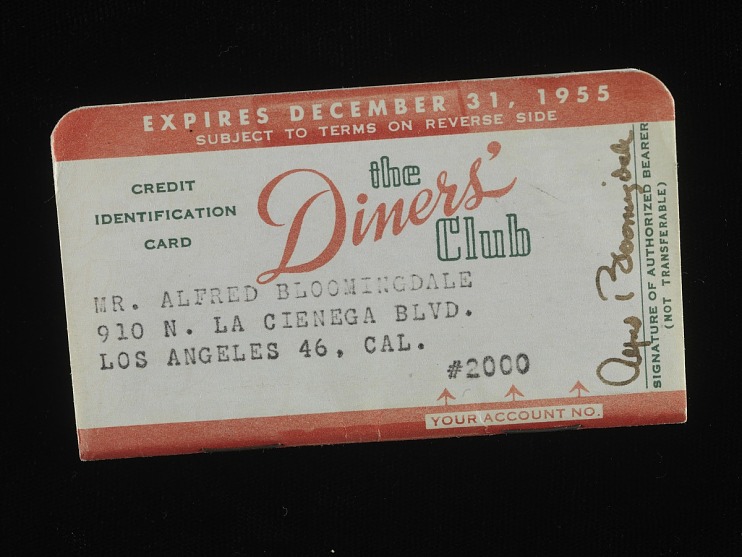

The first credit card was introduced in 1949 with the Diners Club Card. This allowed business travelers (primarily men) to pay for travel and dining expenses around the country. This was far more convenient than carrying around cash, especially when traveling, which made it wildly popular. However, merchants had to pay a 7% transaction fee, which limited the usage of the card to facilities which catered to wealthy, upper-class businessmen. Still, throughout the 1950s, more networks of merchants were constantly being formed.

Prior to the conception of the credit card, shop owners would often extend credit to repeat customers whom they trusted. However, as cities and shops expanded, this was not always feasible. Some stores began to offer credit tokens, which allowed designated trusted customers to purchase items on credit, meaning that they would purchase the items and be allowed to pay back the money at a later date. However, this was not very convenient for the consumers, as they had to carry around separate credit tokens for each shop.

In the 1950s, after the success of the Diners Club Card, Bank of America began offering its own credit card, Bank Americard (later known as Visa). Customers could now purchase goods and services pretty much anywhere on credit using these cards. Merchants were able to trust that customers would repay their debts because the banks trusted them. However, due to discimination, this service was often only available to rich, white men. The availability of credit was often not extended to other minorities until the Equal Credit Opportunity Act of 1974, which prevented discrimination on the basis of sex, race, religion, marital status, and other factors. Poor people were also far less likely to gain access to credit cards until much later due to the financial burden involved.

The widespread use of credit cards by the late 1950s and early 1960s changed the way society bought and sold items. People could now buy first and pay later. They could even purchase items with money that they didn't yet have, and it was easy to take out loans or even go into debt. As a result, household debt skyrocketed. This also dramatically changed consumer culture and the way people spent money. Because of the ease of purchasing goods, people were far more likely to purchase more items.

Thus, the credit card was chosen because of its outsized impact on society, even today. Now, almost everyone has at least one credit card, and the shift away from physical currency that started over 60 years ago is in full swing. Some people spend more than they should due to how easy it is to purchase items with credit cards, and this leads to an increase in credit card debt. Credit cards caused a huge shift in the way that people spent their money in the 1950s, and those ramifications are still visible to this day.